city of richmond property tax 2021

To learn more about transferring to E-STAR go to the School Tax Relief for Homeowners STAR page. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes.

Transaction Management App Mevi Eases Clients Document Overload Tech Review In 2021 State Of Colorado Tech Review Ease

Richmond Hills Property Standards By-law No.

. Any combination of credit cards andor e-checks may be used to make a payment. It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education. Late payment penalties will apply to 2021 tax instalments.

Access financial information including annual financial reports. Municipal Code Chapter 1010 - Property Standards By-law No. If you own a property you will have to pay property tax.

For more information on property standards please view our Property Standards page or view the Property Standards By-law. Payments for property taxes may be done online via mail or in person at the Harris Tax Office. Richmond Mayor Levar Stoney and several members of the City Council are proposing a 2-cent reduction to the citys real estate tax rate to get voters behind a second casino referendum.

For tax year 20222023 92000 or less. All taxpayers with an outstanding balance of 10 or more will receive a reminder notice early in December 2020. Property tax is a tax on land and property.

WOWA Trusted and Transparent. Property Standards By-law. Important note The Province of BCs Speculation and Vacancy Tax External website opens in new tab is in addition to the Citys Empty Homes Tax.

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. The tax team is always available to answer your questions and can be reached by phone at 519-661-2489 or via email at taxofficelondonca However. Properties deemed or declared empty in the 2021 reference year will be subject to a tax of 3 of the propertys 2021 assessed taxable value.

Madison and Milwaukee both 55 percent Wisconsin also impose low combined state and local sales tax rates. The 2020-2023 Business Plans provide a high level overview of the service what the service does and how much it costs to provide to the residents of London. 79-99 sets minimum standards for the maintenance and occupancy of properties.

Hamilton County collects on average 153 of a propertys assessed fair market value as property tax. Whether you are a long-time resident business owner or are new to our area we welcome you to our community. It is based on the assessed value of a property.

Property tax payers may pay their bills using a variety of credit cards or e-checks. We have compiled a few of the most frequently asked questions the team receives about the City of Londons property taxes. The total household income of all owners residents and non-residents and any owners spouse living on the property must be.

All property owners in Richmond Hill must pay their property taxes. In 2019 the City of Vancouvers official property tax rate was 0256116. Baltimore City has one of the highest median property taxes in the United States and is ranked 543rd of the 3143 counties in order of median property taxes.

The median property tax in Baltimore City Maryland is 1850 per year for a home worth the median value of 160400. Property Tax in Ontario. Richmond Virginia had a 53 percent rate until October 1 2020 when the Central Virginia region became the states.

Learn about property tax payment options and tax rebate programs. Baltimore City collects on average 115 of a propertys assessed fair market value as property tax. If you bought or owned a 1M condo you may expect to pay an annual property tax of 2926 1M x Property Tax Rate.

Ontario Property Tax Calculator 2021. Effective September 13 2021 proof of COVID-19 vaccination is required for certain activities. Partial payments may be accepted and any penalties or interest will be minimized.

Beyond the bricks and mortar streets and open spaces the City of New Richmond is made up of inspiring natural areas amazing schools eclectic businesses and community members who support the. In reality you would likely pay around 3500 in annual property taxes due to differences between the assessed value of the property and its market value. For tax year 20212022 90550 or less.

Statement against Racism Violence In May 2020 Richmond City Council adopted and endorsed the following statement against Racism and Violence related to the COVID-19 pandemic. Beginning January 31 2021 interest on unpaid taxes will be applied monthly. Welcome to the City Beautiful population 10075.

Pin By Jeremy Green On Tattoos In 2021 Luxury Retreats Reading Loft Mansions Luxury

Municipal Court City Of Richmond

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

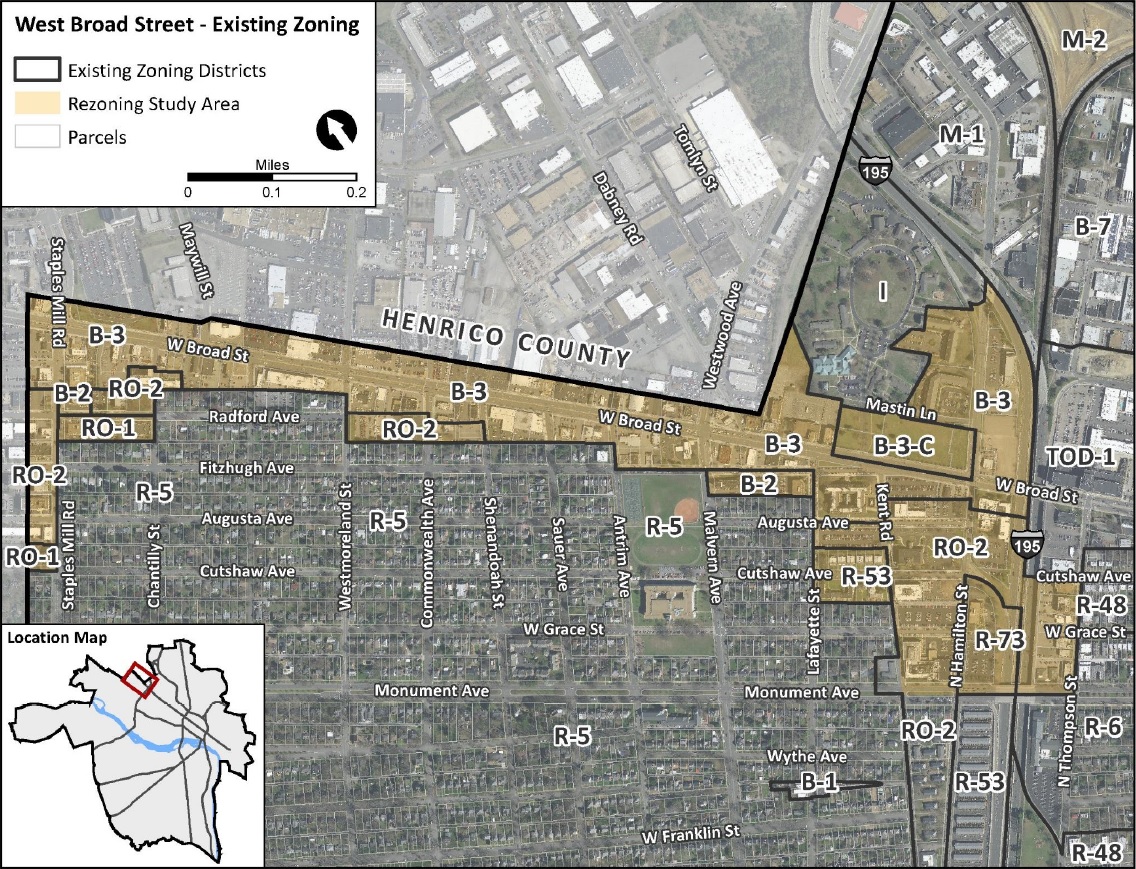

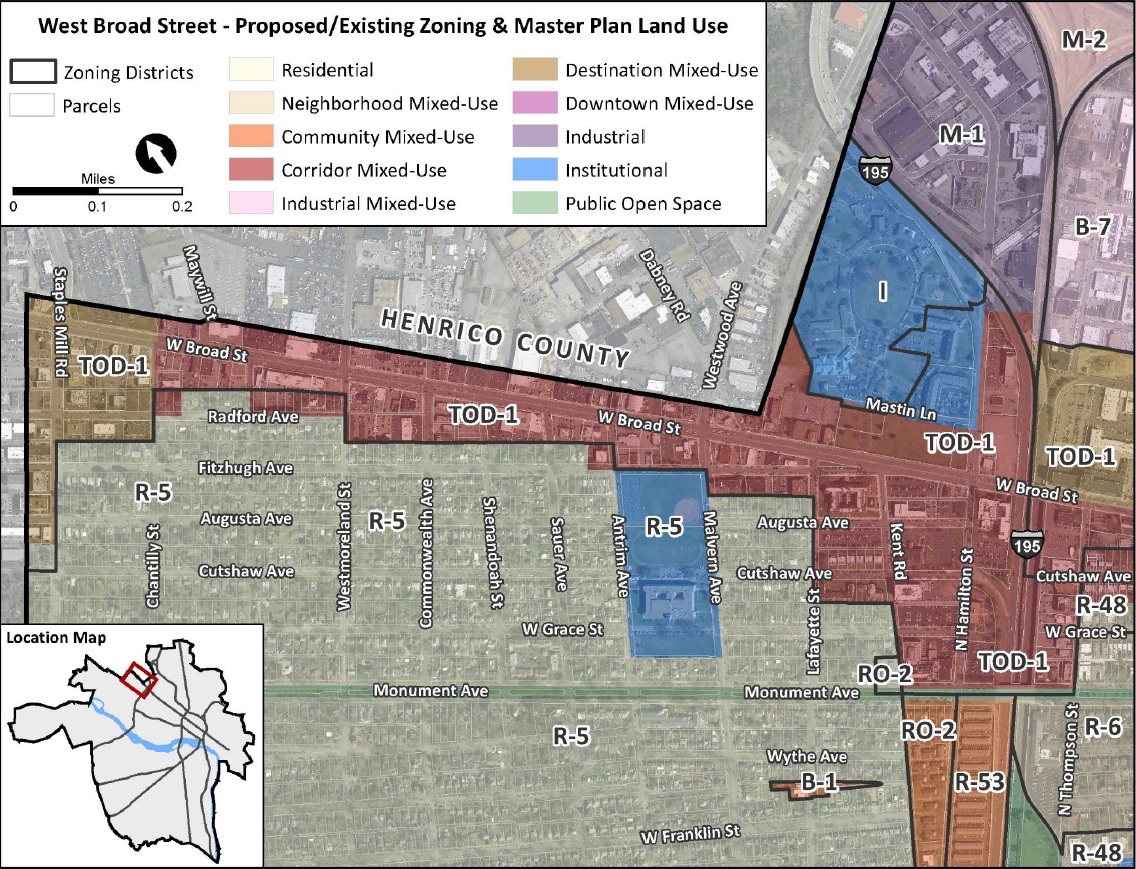

City Ponders Plan To Extend Tod Zoning Westward Along Broad Street Richmond Bizsense

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

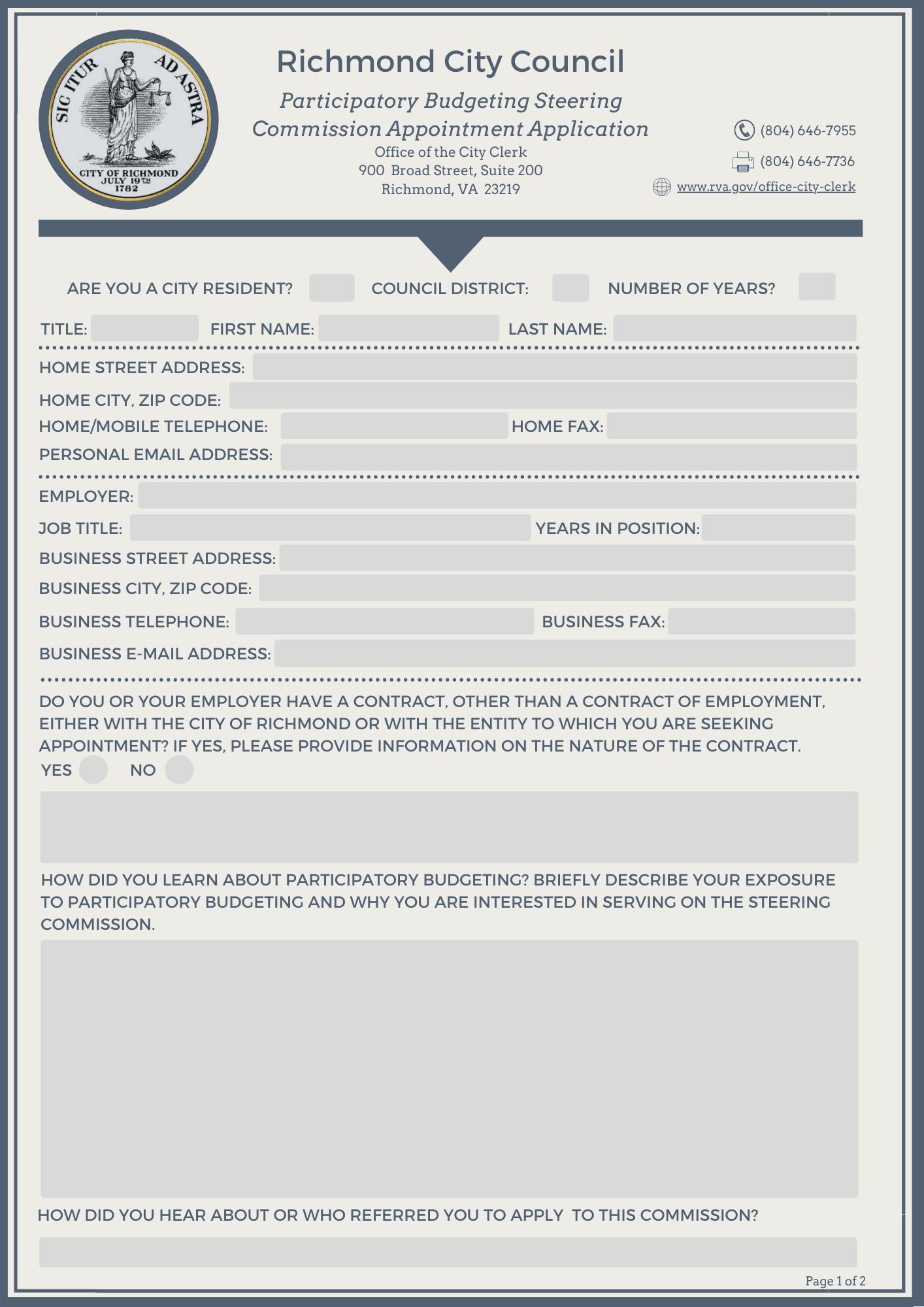

Boards And Commissions Richmond

City Of Richmond Richmond Missouri

City Of Richmond Richmond Missouri

Photo Images Of Richmond Virginia Richmond Virginia Richmond Va Places To Visit Richmond

City Of Richmond Richmond Missouri

City Ponders Plan To Extend Tod Zoning Westward Along Broad Street Richmond Bizsense

State Penitentiary Richmond Virginia Virginia History Richmond Va

City Of Richmond Richmond Missouri