according to the trial balance what is the working capital cash 10 000

A Trial balance is a summary of balances of all accounts recorded in the ledger. Types of Assets Common types of assets include current non-current physical intangible operating and.

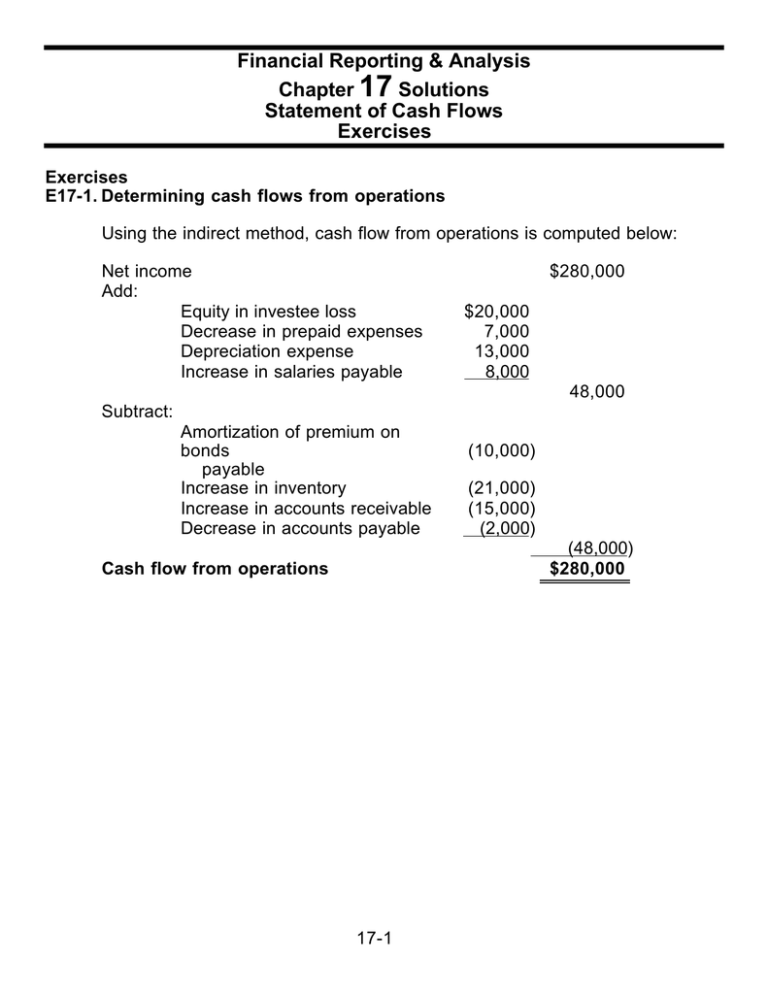

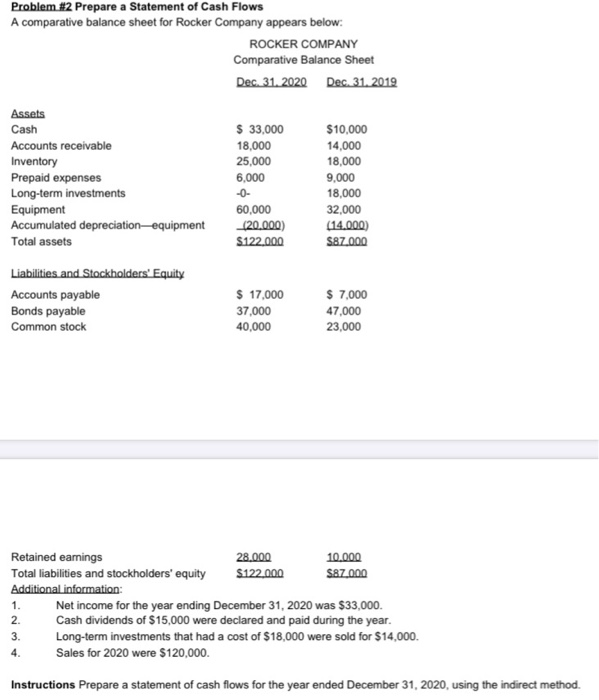

Paper 1 Accounting Questions Cash Flow Statements 1

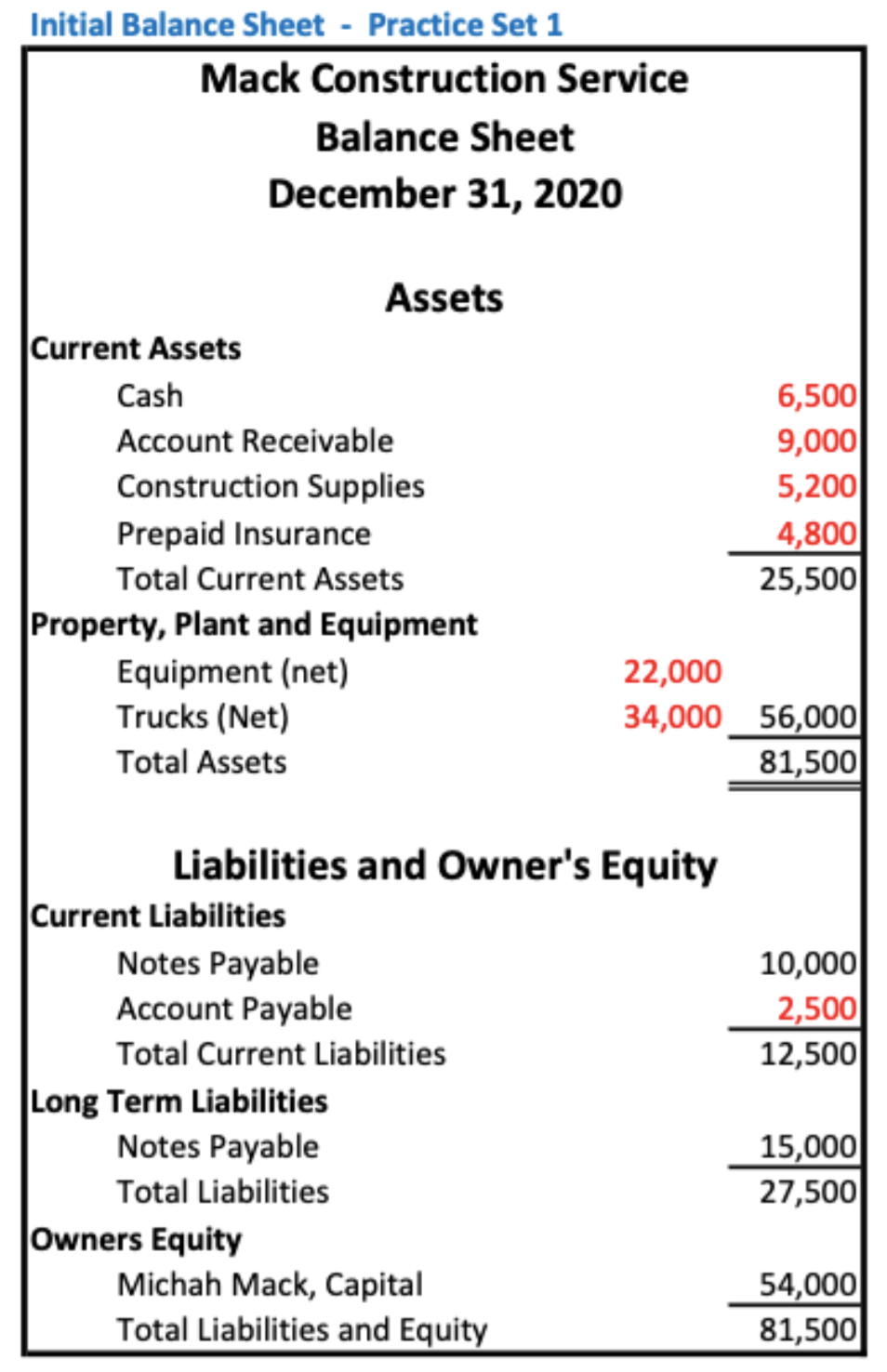

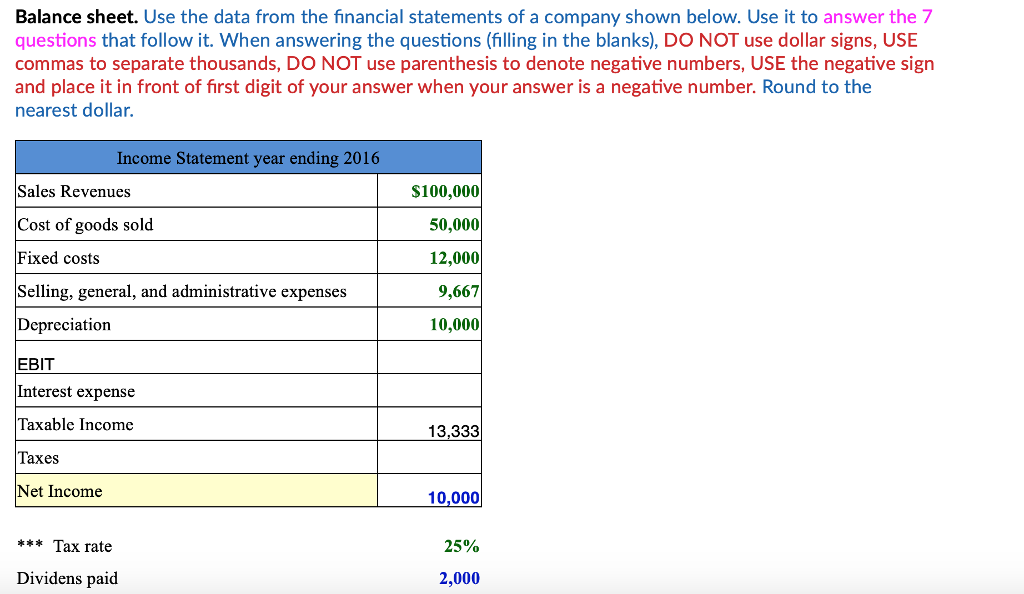

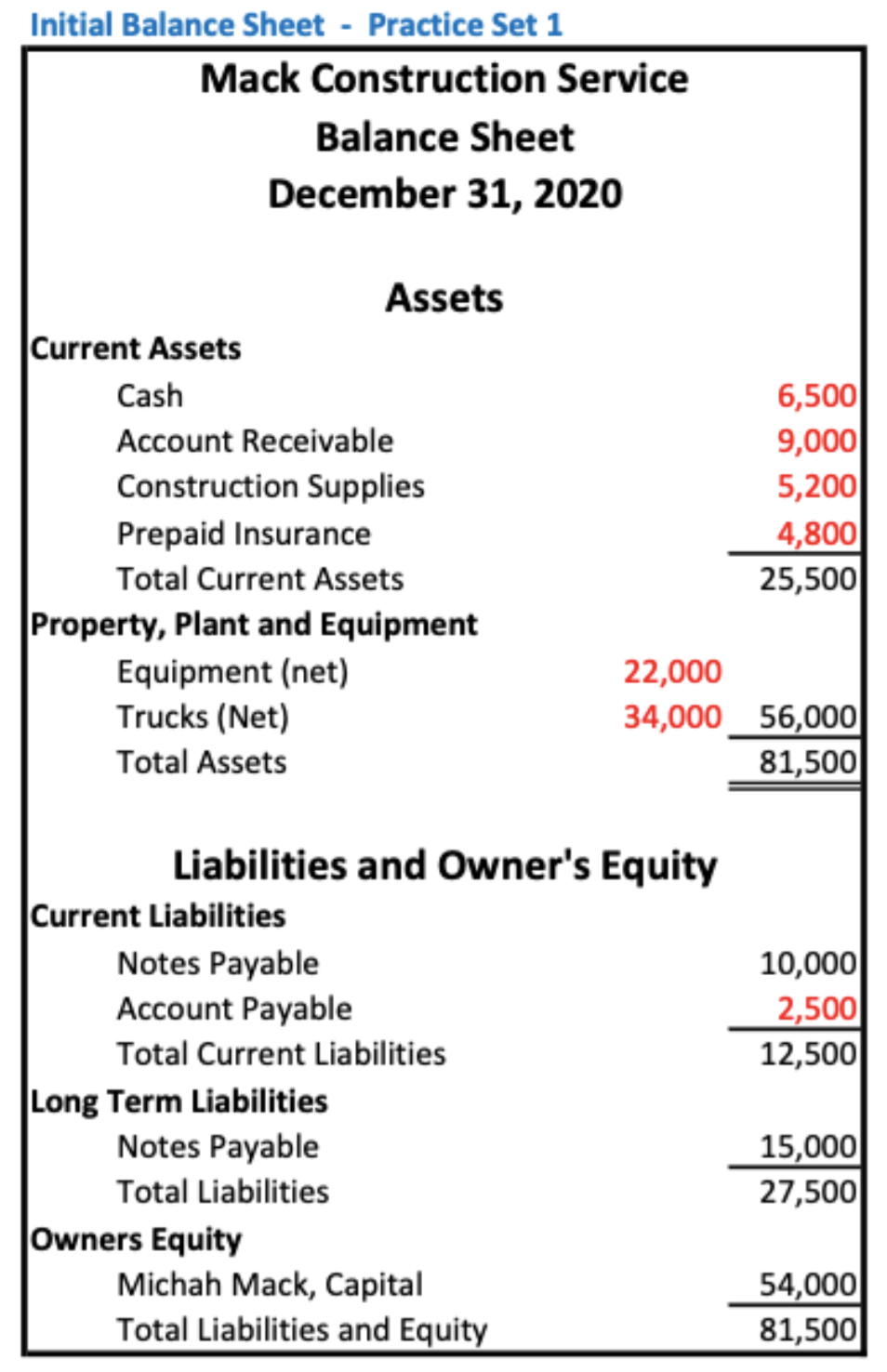

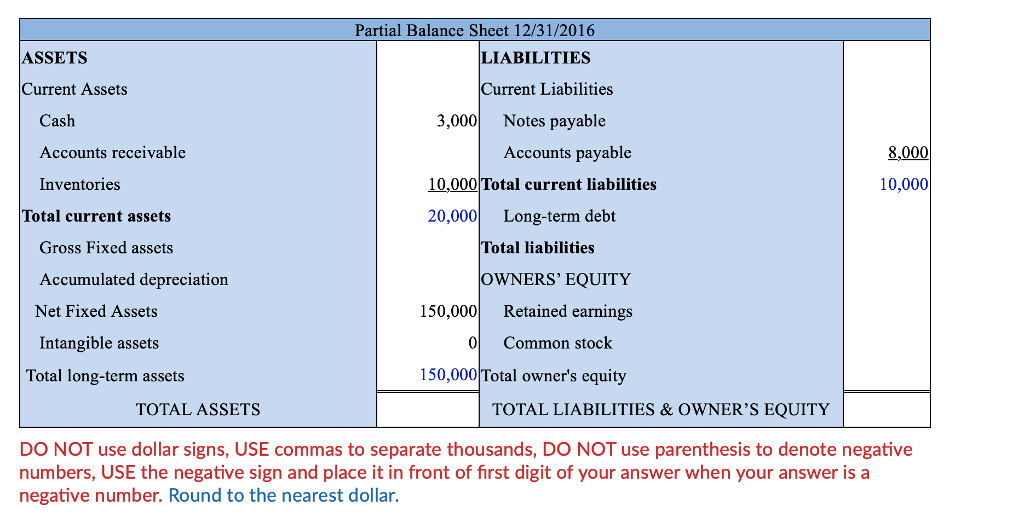

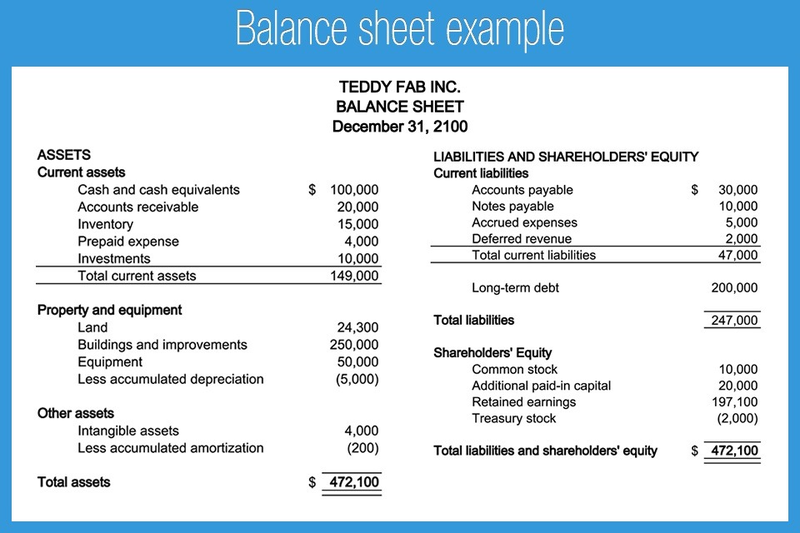

Lets assume that a companys balance sheet dated June 30 reports the following amounts.

. It measures a companys. Working capital is the amount of available capital that a company can readily use for day-to-day operations. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts.

The accounts reflected on a trial balance are related to all major accounting. For example if you know that the remaining balance in prepaid insurance should be 600 you can look at the unadjusted trial balance to see how much is currently in the account. Total amount of current liabilities is 310000.

The appropriate columns are as follows. Example of Working Capital. Current liabilities are debts that are due within one year or one operating cycle.

And a business needs to maintain optimum level of working capital in order to achieve the objectives of profitability and liquidity. Selling of Finish product in cash 3500000. Below is a list of all of our balances from our ledgers.

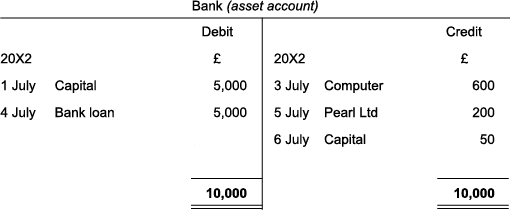

In simple presentation format the TB is laid out with all six types of accounts in the following order. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31 2018. Definition and Examples of Working Capital.

Prepare a Trial Balance. Liabilities Credit balance. Assets Expenses Drawings.

The companys balance of cash does not reflect a bank service fee of35 and interest earned on the checking account of 46. A balance sheet is a statement that represents the financial. The unadjusted trial balance is created by transferring the accounts and.

If there is a difference accountants have to locate and rectify the errors. When the totals are same you may close the trial balance. Using the amounts from the above balance sheet we have.

See the answer See the answer done loading. Refer to the following adjusted trial balance. The trial balance is prepared after all the transactions for the period have been journalized and posted to the General Ledger.

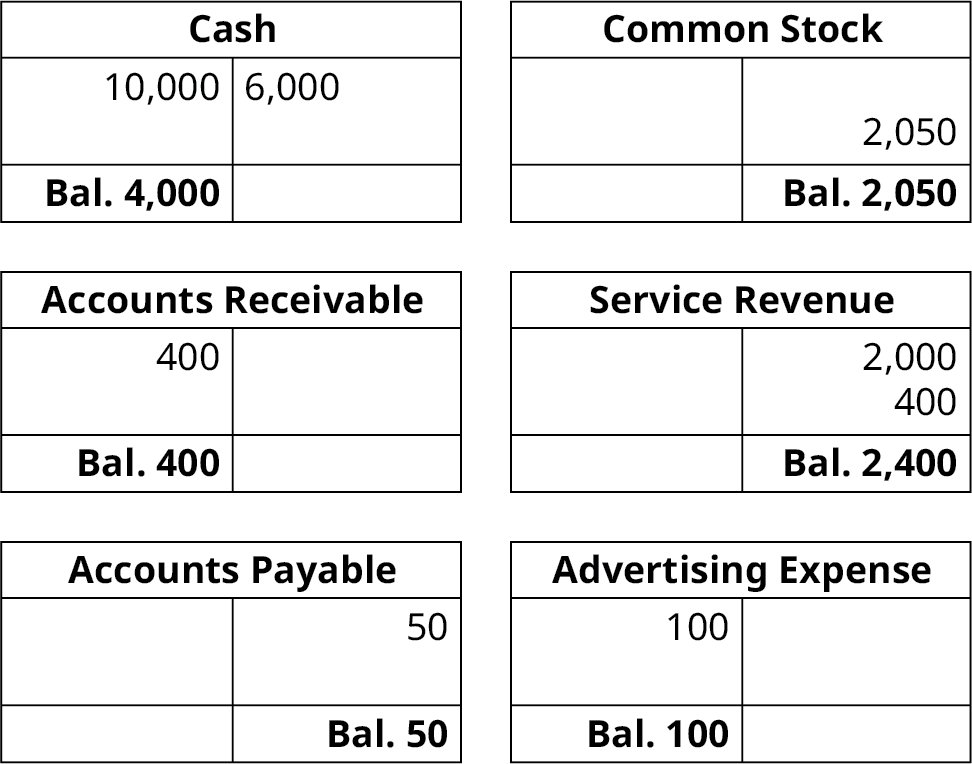

First of all we take all the balances from our ledgers and enter them into our trial balance table. You have calculated these balances in tutorial 8. Therefore funds are required in order to run day-to-day operations of the business.

Finally it is explained why there is no Current Earnings line on the trial balance TB. These amounts are included in the balance of cash of6042 reported by the bank as of the end of August. The assignment of a numerical value to each account assists in data management in much the same way as zip codes help move mail more efficiently.

A trial balance is a listing of the ledger accounts along with their respective debit or credit balances. Following is an example of what a simple Trial Balance looks like. A trial balance is a financial statement that a business prepares at the end of an accounting period just before making adjusting entries.

Key to preparing a trial balance is making sure that all the account balances are listed under the correct column. Current assets are assets that a company plans to use over the same period. Purchase of Raw Material on credit 2500000.

Gold Gems has reported the below transactions for the month of Feb 2019 and the accountant wants to prepare the trial balance for the month of Feb 2019. See Lesson 1 for types of. Account Title shows the name of the accounting ledgers from which the balances have been extracted.

Add up the amounts of the debit column and the credit column. This trial balance reflects all the activity recorded from day-to-day transactions and is used to analyze accounts when preparing adjusting entries. Trial Balance Cash Accounts Receivable AR Inventory Accounts Payable AP Accrued Expenses AE Revenue 10000 2000 3000 2000 3000 15000.

Here are some instances of errors in the trial balance. An unadjusted trial balance is created first and used to make adjusted entries close the books and prepare the final versions of the financial statements. First is the amount of net current assets or working capital.

Definition of Working Capital. The classified balance sheet allows users to quickly determine the amount of the companys working capital. Liabilities Revenue Owners Equity.

A companys working capital must be managed so that cash will be available to pay the. Working capital 170000 of current assets minus 100000 of current liabilities 70000. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

Trial Balance Example 2. Purchase of Raw Material in cash 2500000. From this point the short hand of TB is used to represent the term trial balance.

Assets Debit balance. Ideally the totals should be the same in an error-free trial balance. A balanced trial balance ascertains the arithmetical accuracy of financial records.

QUESTION 4 11 According to the trial balance what is the working capital. Working capital is the amount of a companys current assets minus the amount of its current liabilities. Therefore the companys working.

Second is the method of financing working capital. Title provided at the top shows the name of the entity and accounting period end for which the trial balance has been prepared. If the price per unit of the product is 1000 and the cost per unit in inventory Inventory Inventory is a current asset account found on the balance sheet consisting of all raw materials work-in-progress and finished goods that a is 600 then the companys working capital will increase by 400 for every unit sold because either cash or accounts receivable Accounts.

Once all the monthly transactions have been analyzed journalized and posted on a continuous day-to-day basis over the accounting period a month in our example we are ready to start working on preparing a trial balance unadjusted. Remember the accounting equation. 101 for Cash 102 for Accounts Receivable etc liabilities with 2 and so forth.

Working capital is the money a business would have leftover if it were to pay all its current liabilities with its current assets. Total amount of current assets is 323000. Balances relating to assets and expenses.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

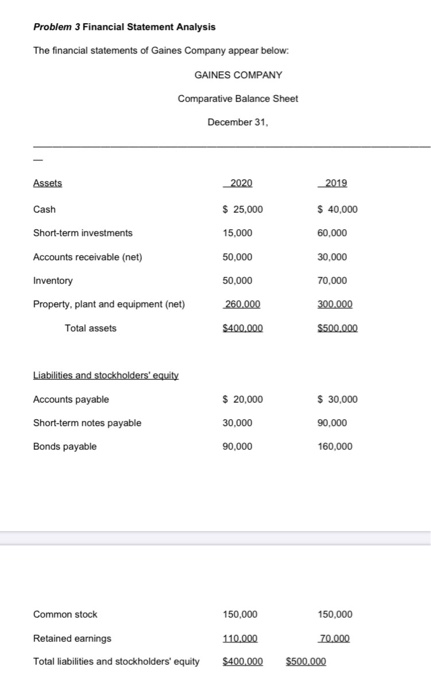

Solved Balance Sheet Use The Data From The Financial Chegg Com

Unadjusted Trial Balance Format Uses Steps And Example

Company Final Accounts Problems And Solutions Accounting Problem And Solution Accounting Solutions

Balancing Off Accounts 1 Business Person Accounting Business Account

Direct Method Cash Flows Adjustments Review Positive Cash Flow Cash Flow Statement Cash Flow

Worksheeta Png 956 527 Trial Balance Accounting Accounting Principles

Week 4 Preparing The Trial Balance And The Balance Sheet View As Single Page

Solved Initial Balance Sheet Practice Set 1 Mack Chegg Com

Solved Problem 2 Prepare A Statement Of Cash Flows A Chegg Com

Worksheeta Png 956 527 Trial Balance Accounting Accounting Principles

17 Financial Reporting Amp Analysis Chapter Solutions

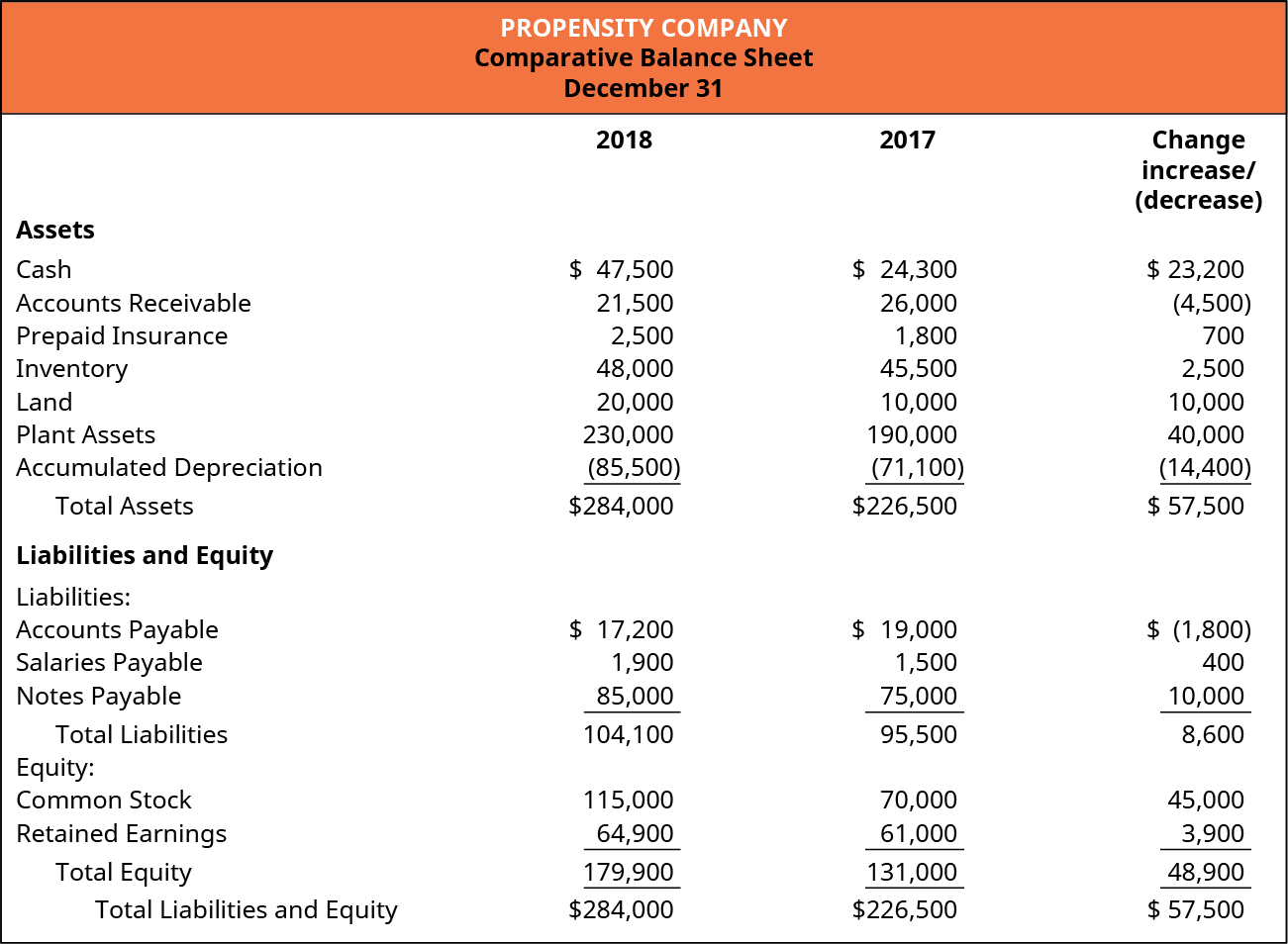

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Pin By Naimat Ullah On Free Learning Center Learning Centers Trial Balance Accounting Software

Solved Balance Sheet Use The Data From The Financial Chegg Com

Solved Problem 2 Prepare A Statement Of Cash Flows A Chegg Com

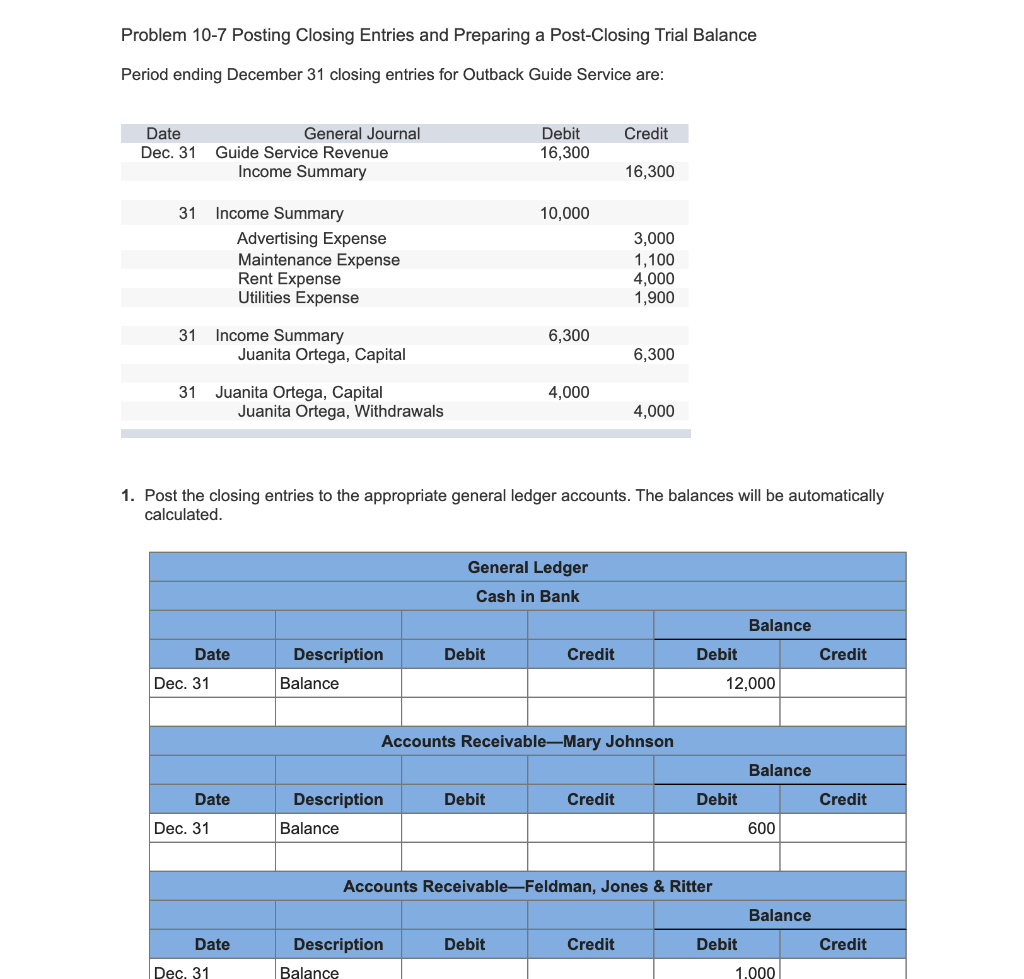

Solved Problem 10 7 Posting Closing Entries And Preparing A Chegg Com

Pin By Naimat Ullah On Free Learning Center Learning Centers Trial Balance Accounting Software

A Small Business Guide To Calculating Net Working Capital The Blueprint

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting